Services

Our Company offers a Technology led financial & investment services to help individuals and businesses achieve their financial goals. One of our key services is the offering of mutual funds, which provide investors with a diversified portfolio of investments that are managed by a team of professional fund managers.

MUTUAL FUNDS

What are

Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, and other securities. This allows investors to access a range of assets that they may not be able to afford or have the knowledge to select on their own. The fund is managed by a team of professionals who buy and sell assets on behalf of the investors, and the returns are distributed among the investors based on their proportion of ownership.

Benefits of

Mutual Funds:

- Diversification: Investing in a mutual fund provides diversification, reducing the risk of losing all of your investment in a single asset.

- Professional Management: Mutual funds are managed by a team of investment professionals with the expertise and experience to select and manage a diversified portfolio of investments.

- Liquidity: Mutual funds are traded on exchanges, making it easy for investors to buy and sell shares at any time.

- Affordability: Mutual funds offer investors access to a diversified portfolio of assets at a relatively low cost.

Types of

Mutual Funds:

We offer a variety of mutual funds, including:

- Equity Funds: These funds invest in stocks, providing investors with the potential for long-term growth.

- Bond Funds: These funds invest in bonds, providing investors with a steady income and lower risk.

- Balanced Funds: These funds invest in a mix of stocks and bonds to provide a balance of growth and income.

- Index Funds: These funds track a specific market index, providing investors with exposure to a broad market at a low cost.

TRADING

What is

Trading?

Trading is the buying and selling of securities such as stocks, bonds, options, and futures with the aim of making a profit. Investors can buy securities when they believe the price will increase in the future and sell them when they believe the price will decrease. Trading can be done through online platforms or with the help of a professional broker.

Benefits of

Trading:

- Potential for Profits: Trading provides investors with the potential to earn profits by buying and selling securities at the right time.

- Flexibility: Investors can buy and sell securities in real-time, allowing them to take advantage of market fluctuations and adjust their investment strategies accordingly.

- Diversification: Trading allows investors to diversify their investment portfolios by investing in a range of securities across different markets and sectors.

- Control: Investors have full control over their trading decisions and can adjust their investment strategies as needed.

Types of

Trading:

We offer a range of trading services, including:

- Stock Trading: This involves buying and selling shares of individual stocks listed on stock exchanges.

- Options Trading: This involves buying and selling options contracts, which give investors the right to buy or sell an underlying asset at a specified price and date.

- Futures Trading: This involves buying and selling futures contracts, which give investors the right to buy or sell an underlying asset at a specified price and date in the future.

- Forex Trading: This involves buying and selling currencies in the foreign exchange market.

SYSTEMATIC INVESTMENT PLAN (SIP)

SIP

Our SIP service is designed to help our clients invest in a disciplined and structured manner. Through SIP, our clients can invest a fixed amount of money at regular intervals in a mutual fund scheme. This helps in building a corpus over time and achieving long-term financial goals. Our team of experts will help our clients choose the best mutual fund schemes that align with their investment objectives.

How SIP works:

SIP is an investment tool that allows investors to invest a fixed amount of money at regular intervals, such as monthly or quarterly. This can help investors inculcate a habit of disciplined investing, as well as help them achieve their long-term financial goals. When investors invest through SIP, they get the benefit of rupee-cost averaging, which means that they buy more units when the market is down and fewer units when the market is up. This helps in reducing the average cost of the acquisition of units.

Benefits of investing through

SIP:

- Discipline: Investing through SIP helps investors inculcate a habit of disciplined investing.

- Flexibility: Investors can start with a small amount and increase their investments gradually.

- Rupee-cost averaging: Investors get the benefit of buying more units when the market is down and fewer units when the market is up, thereby reducing the average cost of acquisition.

- Long-term wealth creation: SIP helps investors create long-term wealth by investing in mutual fund schemes that have the potential to generate higher returns than other traditional investment options.

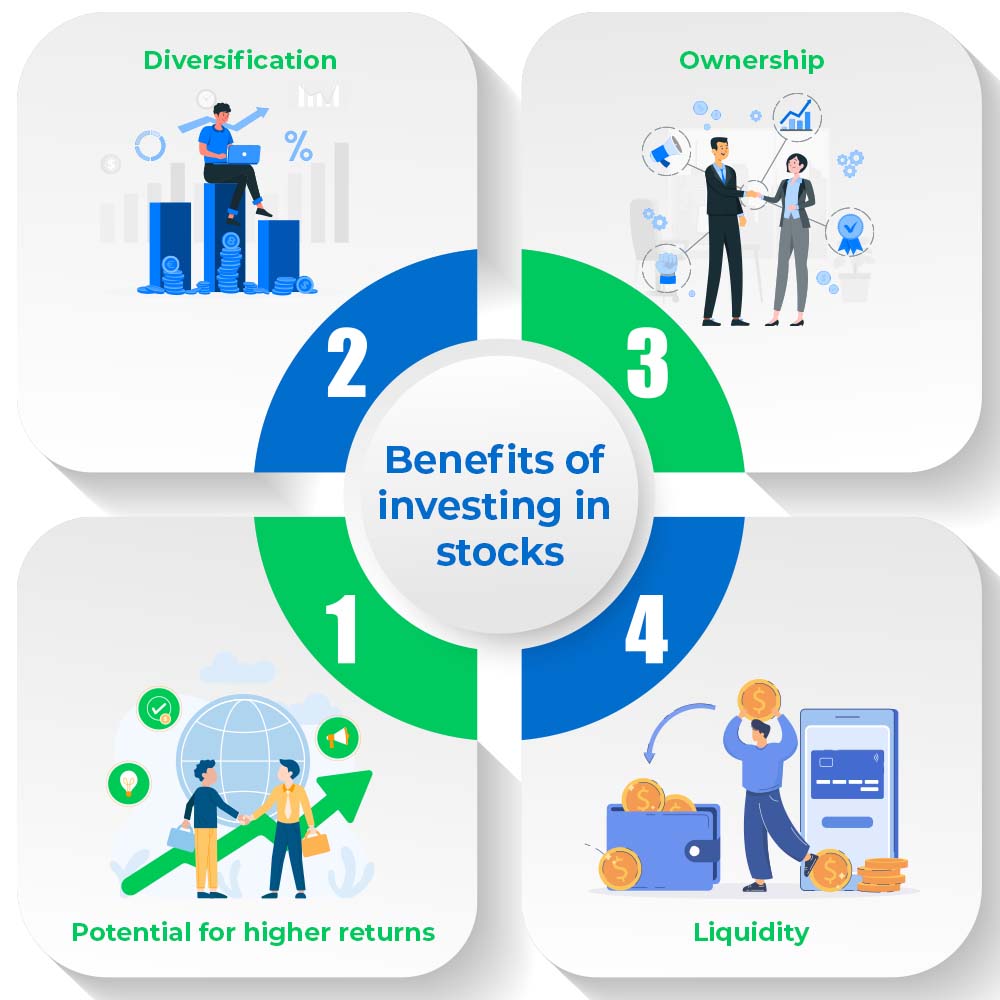

Stock Market

Our SIP service is designed to help our clients invest in a disciplined and structured manner. Through SIP, our clients can invest a fixed amount of money at regular intervals in a mutual fund scheme. This helps in building a corpus over time and achieving long-term financial goals. Our team of experts will help our clients choose the best mutual fund schemes that align with their investment objectives.

Benefits of investing

in stocks:

- Potential for higher returns: Stocks have the potential to generate higher returns than other traditional investment options.

- Diversification: Investing in stocks can help diversify your portfolio and reduce your overall risk.

- Ownership: When you invest in stocks, you become a part-owner of the company, and you have a say in the company’s decision-making process.

- Liquidity: Stocks are highly liquid, which means you can easily buy and sell them as per your convenience.

Health Insurance

We understand the importance of protecting our clients’ health and well-being. That is why we offer a range of health insurance plans that are designed to meet our clients’ specific needs. Our team of experts will help our clients choose the right health insurance plan that offers comprehensive coverage at an affordable price.

Benefits of health

insurance:

- Protection: Health insurance offers protection against unexpected medical expenses, which can be financially crippling.

- Peace of mind: Knowing that you and your family are covered by a comprehensive health insurance plan can give you peace of mind.

- Access to quality healthcare: Health insurance plans offer access to quality healthcare facilities and services.

- Tax benefits: Health insurance premiums are eligible for tax benefits under Section 80D of the Income Tax Act.

Our Health

Insurance Services:

We offer a range of health insurance plans, including individual health insurance plans, family health insurance plans, and group health insurance plans. Our team of experts will help our clients choose the right health insurance plan that meets their specific needs and budget. We also offer value-added services, such as cashless hospitalization, wellness programs, and health check-ups.